Abstract:

In the realm of financial reporting, Ind AS 36 stands tall as a cornerstone standard governing impairment testing. This exhaustive guide embarks on a journey through the intricate landscape of impairment testing, unraveling its nuances, methodologies, and practical implications. From understanding the conceptual framework to navigating the complexities of implementation, this comprehensive resource equips professionals with the knowledge and insights needed to excel in the realm of impairment testing.

Table of Contents:

- What is Impairment Testing?

- Decoding Ind AS 36: Objectives and Scope

- Key Concepts and Definitions

- Methodologies for Assessing Impairment

- Step-by-Step Process of Impairment Testing

- Practical Considerations and Challenges

- Impact on Financial Reporting

- Disclosure Requirements and Best Practices

Chapter 1: What is Impairment Testing?

Historical Context and Evolution of Impairment Standards

The historical context and evolution of impairment standards provide valuable insights into the development of accounting principles and regulatory frameworks:

- Traditional Accounting Practices: Historically, accounting standards primarily focused on historical cost accounting, whereby assets were initially recorded at their historical purchase price. However, this approach often led to discrepancies between reported values and economic realities.

- Emergence of Fair Value Accounting: With the recognition of limitations in historical cost accounting, fair value accounting gained prominence. Fair value accounting reflects current market values, providing a more accurate representation of asset values and enabling timely recognition of changes in value.

- Evolution of Impairment Standards: In response to the need for consistent and transparent impairment assessments, accounting standards bodies developed impairment standards such as IAS 36 (International Accounting Standard 36) and its Indian counterpart, Ind AS 36. These standards provide guidance on assessing and recognizing impairment losses, ensuring uniformity and comparability in financial reporting.

- Global Convergence: The convergence of accounting standards towards International Financial Reporting Standards (IFRS) has further standardized impairment testing practices worldwide. This convergence promotes consistency and comparability in financial reporting across jurisdictions, facilitating global investment and capital allocation.

Importance of Impairment Testing in Financial Reporting

Impairment testing holds paramount importance in financial reporting for several reasons:

- Accurate Asset Valuation: Impairment testing ensures that assets are carried on the balance sheet at their recoverable amount, reflecting their true economic value. This accuracy is essential for providing stakeholders with reliable financial information.

- Transparency and Disclosure: Impairment testing enhances transparency by disclosing any declines in asset values that may affect an entity’s financial health. Proper disclosure of impairment losses enables stakeholders to make informed decisions about the entity’s performance and prospects.

- Compliance with Accounting Standards: Many accounting standards, including Ind AS 36, require entities to perform impairment testing on assets regularly. Compliance with these standards is crucial for maintaining the integrity and credibility of financial statements.

- Risk Management: Identifying and recognizing impairment losses promptly allows entities to mitigate risks associated with overvalued assets. By accurately reflecting the value of assets, impairment testing helps management make informed decisions about resource allocation and strategic planning.

- Investor Confidence: Transparent and accurate financial reporting, facilitated by impairment testing, enhances investor confidence in the entity. Investors rely on financial statements to assess the entity’s financial health and make investment decisions, making the integrity of asset valuations critical.

What all assets are subject to Impairment?

- Tangible Assets: These are physical assets such as property, plant, and equipment (PP&E), and their impairment might occur due to physical damage, changes in market value, or changes in the way they are used.

- Intangible Assets: These are non-physical assets such as patents, copyrights, trademarks, and goodwill. Intangible assets are often subject to impairment due to changes in market conditions, technological advancements, or changes in the business environment.

- Financial Assets: Investments in stocks, bonds, or other financial instruments may be subject to impairment if their market value declines significantly and the decline is deemed to be other-than-temporary.

- Long-term Investment: Investments in subsidiaries, associates, or joint ventures may be subject to impairment if there are indications that the value of these investments has decreased.

- Goodwill: Goodwill arises when a company acquires another company for a price higher than the fair value of its identifiable net assets. Goodwill is tested for impairment annually or more frequently if certain events indicate that it might be impaired.

- Natural Resources: Assets such as oil and gas reserves, mineral deposits, and timberlands may be subject to impairment if their carrying value exceeds their recoverable amount.

It is essential for businesses to regularly assess whether there are indications of impairment for these assets, and if so, to conduct impairment tests to determine the extent of impairment and whether any adjustments to the asset’s carrying value are necessary.

Chapter 2: Decoding Ind AS 36: Objectives and Scope

Overview of Ind AS 36 and its Objectives

Ind AS 36 is an accounting standard issued by the Institute of Chartered Accountants of India (ICAI) that provides guidance on the impairment of assets. It outlines the principles and procedures for assessing whether an asset’s carrying amount exceeds its recoverable amount and requires impairment losses to be recognized where necessary.

Objectives of Ind AS 36:

- Ensure Accurate Asset Valuation: The primary objective of Ind AS 36 is to ensure that assets are carried on the balance sheet at no more than their recoverable amount, reflecting their true economic value.

- Promote Transparency and Reliability: By requiring impairment testing and recognition of impairment losses, Ind AS 36 aims to enhance the transparency and reliability of financial statements, providing stakeholders with accurate information about an entity’s financial health.

- Facilitate Informed Decision Making: Ind AS 36 helps stakeholders, including investors, creditors, and management, make informed decisions by providing insights into the recoverable amounts of assets and the potential impact of impairment on financial performance.

Applicability and Scope of the Standard

Applicability: Ind AS 36 applies to all entities that prepare financial statements in accordance with Indian Accounting Standards (Ind AS), including listed and unlisted companies, as well as entities in the public and private sectors. It applies to all assets, except for assets that are specifically covered by other standards, such as financial instruments and inventories.

Scope of the Standard:

- Tangible and Intangible Assets: Ind AS 36 applies to both tangible assets, such as property, plant, and equipment, and intangible assets, such as goodwill, patents, and trademarks.

- Financial Assets: While financial assets are generally covered by other standards (e.g., Ind AS 109), Ind AS 36 applies to financial assets that are subject to impairment testing under specific circumstances, such as loans and receivables.

- Exclusions: Certain assets are excluded from the scope of Ind AS 36, including inventories, deferred tax assets, and assets arising from employee benefits, which are subject to impairment testing under other standards.

Relationship with Other Accounting Standards

- Ind AS 16 (Property, Plant, and Equipment): Ind AS 36 provides guidance on impairment testing for tangible assets covered by Ind AS 16, ensuring that impairment assessments are aligned with asset valuation principles.

- Ind AS 38 (Intangible Assets): Ind AS 36 complements Ind AS 38 by providing specific guidance on impairment testing for intangible assets, such as goodwill, patents, and trademarks.

- Ind AS 109 (Financial Instruments): While Ind AS 109 primarily governs the recognition and measurement of financial assets, Ind AS 36 applies to financial assets subject to impairment testing under specific circumstances, ensuring consistency in impairment assessments.

- Consistency and Comparability: The relationship between Ind AS 36 and other accounting standards promotes consistency and comparability in impairment assessments across different types of assets and entities. By adhering to consistent principles and methodologies, entities can ensure that impairment assessments accurately reflect the economic realities of their assets.

- Disclosure Requirements: Ind AS 36 requires entities to disclose key information about impairment assessments, including the methods and assumptions used, the amount of impairment losses recognized, and the impact on financial statements. These disclosures provide stakeholders with insights into the reliability and transparency of impairment assessments, enhancing the credibility of financial reporting.

Significance of Ind AS 36 in the Indian Accounting Landscape

Ind AS 36 holds significant importance in the Indian accounting landscape for several reasons:

- Alignment with International Standards: Ind AS 36 is aligned with International Financial Reporting Standards (IFRS), ensuring consistency and comparability with global accounting practices. This alignment enhances the credibility of Indian financial statements and facilitates cross-border investment and business operations.

- Comprehensive Guidance on Impairment Testing: Ind AS 36 provides comprehensive guidance on impairment testing, covering a wide range of assets, including tangible and intangible assets, financial assets, and goodwill. This guidance ensures uniformity and transparency in impairment assessments across Indian entities.

- Enhanced Transparency and Disclosure: By mandating impairment testing and disclosure requirements, Ind AS 36 promotes transparency in financial reporting. Entities are required to disclose key assumptions, judgments, and estimates used in impairment testing, providing stakeholders with insights into the reliability of asset valuations.

- Investor Confidence and Stakeholder Trust: Compliance with Ind AS 36 enhances investor confidence and stakeholder trust by ensuring accurate and transparent financial reporting. Investors rely on financial statements to assess an entity’s financial health and performance, making the integrity of impairment assessments crucial for maintaining trust and credibility.

- Regulatory Compliance: Ind AS 36 is a mandatory accounting standard prescribed by the Ministry of Corporate Affairs (MCA) for Indian companies following the Indian Accounting Standards (Ind AS). Compliance with Ind AS 36 is essential for Indian entities to adhere to regulatory requirements and maintain compliance with accounting standards.

Chapter 3: Key Concepts and Definitions

Understanding Impairment and its Ramifications

Definition of Impairment: Impairment refers to a situation where the carrying amount of an asset exceeds its recoverable amount. In other words, an asset is impaired when its book value is higher than its recoverable value, indicating a decline in its value or future cash-generating ability.

Ramifications of Impairment:

- Financial Statement Impact: Impairment leads to the recognition of impairment losses in the income statement, reducing the reported profit and shareholders’ equity. This adjustment reflects the true economic value of the impaired asset, ensuring accurate financial reporting.

- Stakeholder Perception: Impairment disclosures provide stakeholders with insights into an entity’s financial health and management’s ability to assess and address risks. Transparent reporting of impairment enhances stakeholder trust and confidence in the entity’s financial statements.

- Strategic Decision-Making: Impairment assessments influence strategic decisions regarding asset management, investment allocation, and capital expenditure. Management must consider impairment implications when evaluating asset performance and planning future investments.

Recoverable Amount: A Fundamental Concept

- Definition of Recoverable Amount: The recoverable amount of an asset is the higher of its fair value less costs to sell (FVLCS) and its value in use (VIU). It represents the amount obtainable from either selling the asset in an arm’s length transaction (FVLCS) or using it in the entity’s operations (VIU).

- Fair Value Less Costs to Sell (FVLCS): FVLCS represents the estimated amount that an entity would receive from selling an asset in an arm’s length transaction, less any costs directly attributable to the sale. It reflects the current market value of the asset.

- Value in Use (VIU): VIU represents the present value of the future cash flows expected to be derived from the continued use of the asset and its eventual disposal. It considers factors such as cash flow projections, discount rates, and growth assumptions.

- Significance of Recoverable Amount: The recoverable amount serves as a key benchmark for assessing whether an asset is impaired. By comparing the carrying amount of an asset to its recoverable amount, entities can determine whether impairment losses need to be recognized and adjust asset values accordingly.

Impairment Loss: Recognition and Measurement

- Recognition of Impairment Losses: Impairment losses are recognized when the carrying amount of an asset exceeds its recoverable amount. This recognition reflects the economic loss incurred by the entity due to the decline in the value or future cash-generating ability of the asset.

- Measurement of Impairment Losses: The measurement of impairment losses is based on the difference between the carrying amount of the asset and its recoverable amount. The impairment loss is calculated as the excess of the carrying amount over the recoverable amount and is recognized in the income statement.

- Accounting Treatment: Impairment losses are typically recognized as expenses in the income statement, reducing reported profits and shareholders’ equity. The adjusted carrying amount of the impaired asset is also reflected in the balance sheet, ensuring that asset values accurately reflect their recoverable amounts.

- Disclosure Requirements: Entities are required to disclose key information about impairment losses in the notes to financial statements, including the methods and assumptions used in impairment testing, the amount of impairment losses recognized, and the impact on financial performance.

Chapter 4: Methodologies for Assessing Impairment

FVLCD Method: Fair Value Less Costs of Disposal

- Definition: The Fair Value Less Costs of Disposal (FVLCD) method is an approach used in impairment testing to determine an asset’s recoverable amount. It involves estimating the fair value of the asset in the current market and subtracting the costs directly attributable to its disposal.

- Fair Value: Fair value represents the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

- Costs of Disposal: Costs of disposal include expenses directly associated with selling the asset, such as legal fees, brokerage commissions, and transportation costs. These costs are subtracted from the fair value to determine the net amount the entity would receive upon disposal.

- Application: The FVLCD method is typically used for assets that have active markets or for which market-based pricing information is readily available. It provides a reliable indication of an asset’s recoverable amount when market conditions are favorable.

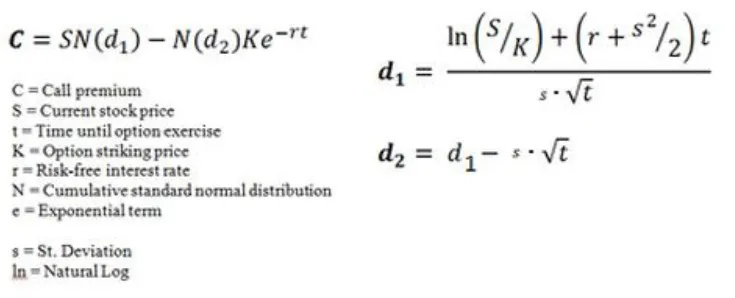

VIU Method: Value in Use and Discounted Cash Flow Techniques

- Definition: The Value in Use (VIU) method is an approach used in impairment testing to determine an asset’s recoverable amount based on its future cash flow projections. It involves estimating the present value of expected future cash flows generated by the asset’s continued use in the entity’s operations.

- Discounted Cash Flow (DCF) Techniques: DCF techniques are commonly used to estimate the present value of future cash flows under the VIU method. This involves forecasting cash flows over a specific period and discounting them back to their present value using an appropriate discount rate.

- Key Components: The VIU method considers factors such as cash flow projections, discount rates, and terminal values to determine the recoverable amount of the asset. Cash flow projections should be based on reasonable and supportable assumptions, while discount rates should reflect the time value of money and the risks associated with the asset.

- Application: The VIU method is particularly suitable for assets that do not have active markets or for which market-based pricing information is not readily available. It provides a comprehensive assessment of an asset’s value based on its expected future cash flows.

Comparative Analysis: Integrating Multiple Methodologies for Robust Assessment

- Rationale: A comparative analysis involves integrating multiple impairment testing methodologies to ensure a robust assessment of an asset’s recoverable amount. By using complementary approaches, entities can mitigate the limitations of individual methods and arrive at more reliable impairment assessments.

- Combining FVLCD and VIU Methods: One approach to comparative analysis is to combine the FVLCD and VIU methods. This involves estimating the recoverable amount using both methods and comparing the results to identify any significant differences or inconsistencies.

- Utilizing Alternative Approaches: In addition to the FVLCD and VIU methods, entities may consider alternative approaches based on specific asset characteristics or circumstances. This could include using market-based valuation techniques, industry benchmarks, or expert opinions to supplement impairment assessments.

- Risk Management and Sensitivity Analysis: Comparative analysis allows entities to evaluate the impact of different assumptions, methodologies, and scenarios on impairment assessments. Sensitivity analysis helps identify key drivers of impairment and assess the level of uncertainty associated with recoverable amount estimates.

- Disclosure and Transparency: Entities should disclose key information about impairment testing methodologies, assumptions, and judgments in the notes to financial statements. This enhances transparency and enables stakeholders to understand the basis for impairment assessments and the reliability of reported values.

Chapter 5: Step-by-Step Process of Impairment Testing

Identification of Assets and Cash-Generating Units (CGUs)

- Assets Identification: This involves identifying individual assets or groups of assets that are subject to impairment testing. An asset is typically identified as an individual item in the balance sheet, but it can also be a group of assets if they are closely interrelated and generate cash inflows largely independently of other assets.

- Cash-Generating Units (CGUs): CGUs are the smallest identifiable group of assets that generate cash inflows largely independent of the cash inflows from other assets or groups of assets. Identifying CGUs is crucial for impairment testing as it helps in determining the scope of impairment assessments and allocating impairment losses to specific units.

- Considerations: When identifying assets and CGUs, entities need to consider various factors such as the nature of the assets, their location, the manner in which they are used in the business, and their cash-generating abilities. Additionally, entities should ensure that assets are not double-counted or overlooked during the identification process.

Determination of Recoverable Amount: Practical Techniques and Approaches

- Practical Techniques: Determining the recoverable amount involves estimating the value of an asset or CGU to assess whether it is impaired. Practical techniques and approaches include:

- Market-based Valuation: Using market comparable or recent transactions to estimate fair value.

- Income Approach: Forecasting future cash flows and discounting them to present value using appropriate discount rates.

- Cost Approach: Assessing the replacement cost or reproduction cost of the asset.

- Valuation Models: Utilizing various valuation models such as discounted cash flow (DCF), comparable company analysis (CCA), or precedent transactions to estimate fair value.

- Assumptions and Judgments: Entities need to make assumptions and judgments when determining the recoverable amount, such as cash flow projections, discount rates, growth rates, and terminal values. These assumptions should be based on reasonable and supportable information, and any significant uncertainties should be disclosed.

- Assumptions and Judgments: Entities need to make assumptions and judgments when determining the recoverable amount, such as cash flow projections, discount rates, growth rates, and terminal values. These assumptions should be based on reasonable and supportable information, and any significant uncertainties should be disclosed.

Recognition of Impairment Losses: Calculation and Accounting Treatment

- Calculation of Impairment Losses: Impairment losses are recognized when the carrying amount of an asset or CGU exceeds its recoverable amount. The impairment loss is calculated as the difference between the carrying amount and the recoverable amount. If the recoverable amount is less than the carrying amount, an impairment loss is recognized.

- Accounting Treatment: Impairment losses are typically recognized in the income statement as expenses, reducing the reported profit for the period. The adjusted carrying amount of the impaired asset is also reflected in the balance sheet, ensuring that asset values accurately reflect their recoverable amounts.

- Disclosure Requirements: Entities are required to disclose key information about impairment losses in the notes to financial statements, including the methods and assumptions used in impairment testing, the amount of impairment losses recognized, and the impact on financial performance. This enhances transparency and enables stakeholders to understand the basis for impairment assessments.

Chapter 6: Practical Considerations and Challenges

Data Accuracy and Reliability: Challenges and Solutions

Challenges: One of the primary challenges in impairment testing is ensuring the accuracy and reliability of the data used in the process. Common challenges include incomplete or outdated information, data inconsistencies, and reliance on subjective estimates. Additionally, data quality issues may arise from changes in market conditions, technological advancements, or regulatory requirements.

Solutions:

- Data Validation and Verification: Implement robust procedures to validate and verify data sources, ensuring accuracy and completeness. This may involve cross-referencing data with external sources, conducting independent reviews, and performing data reconciliation exercises.

- Enhanced Data Governance: Establish clear data governance policies and procedures to ensure data quality and integrity throughout the impairment testing process. This includes defining data ownership, establishing data standards, and implementing controls to monitor data accuracy and reliability.

- Use of Technology: Leverage technology solutions such as data analytics, machine learning, and automation to improve data accuracy and reliability. Advanced analytical tools can identify data anomalies, detect patterns, and enhance the accuracy of impairment assessments.

Market Assumptions and Sensitivity Analysis

- Market Assumptions: Impairment testing often involves making assumptions about future market conditions, such as growth rates, discount rates, and market multiples. These assumptions can have a significant impact on impairment assessments and may introduce uncertainty into the process.

- Sensitivity Analysis: Sensitivity analysis is a technique used to assess the impact of changes in key assumptions on impairment assessments. By varying assumptions within a reasonable range and observing the resulting changes in impairment outcomes, entities can identify the sensitivity of impairment assessments to different scenarios.

- Importance: Market assumptions and sensitivity analysis are crucial for assessing the robustness and reliability of impairment assessments. Sensitivity analysis helps entities understand the potential range of outcomes and identify the key drivers of impairment, enabling informed decision-making and risk management.

Documentation and Audit Trail: Best Practices for Compliance

- Documentation Requirements: Impairment testing requires comprehensive documentation to support the assumptions, judgments, and methodologies used in the process. Documentation should include detailed explanations of data sources, rationale for key assumptions, and descriptions of valuation techniques employed.

- Audit Trail: Establishing a clear audit trail is essential for compliance with regulatory requirements and audit standards. An audit trail provides a transparent record of the impairment testing process, enabling auditors to assess the reliability and integrity of impairment assessments.

Best Practices:

- Standardized Templates: Develop standardized templates and documentation templates for impairment testing to ensure consistency and completeness.

- Version Control: Implement version control procedures to track changes and revisions to impairment assessments over time.

- Cross-Referencing: Cross-reference documentation with external sources, supporting evidence, and regulatory requirements to ensure accuracy and compliance.

- Review and Approval: Establish review and approval processes for impairment documentation, involving key stakeholders and subject matter experts to validate assumptions and methodologies.

Chapter 7: Impact on Financial Reporting

Income Statement: Recognizing Impairment Losses as Expenses

- Recognition of Impairment Losses: When an asset’s carrying amount exceeds its recoverable amount, impairment losses are recognized in the income statement as expenses. These expenses reflect the economic loss incurred by the entity due to the decline in the value or future cash-generating ability of the impaired asset.

- Impact on Profitability: Recognizing impairment losses reduces the reported profit for the period, directly impacting the entity’s profitability. Lower profits may result in decreased earnings per share (EPS), reduced dividends, and a decline in shareholder wealth.

- Transparency and Disclosure: Impairment losses are typically disclosed separately in the income statement to provide stakeholders with visibility into the impact of impairment on financial performance. This enhances transparency and enables stakeholders to understand the reasons behind changes in reported profits.

Balance Sheet: Adjusting Carrying Amounts and Impairment Recognitions

- Adjusting Carrying Amounts: Impairment testing results in adjustments to the carrying amounts of impaired assets on the balance sheet. The carrying amount of the impaired asset is reduced to its recoverable amount, reflecting its true economic value.

- Impairment Recognitions: Impairment losses recognized in the income statement also impact the balance sheet by reducing the reported equity. This adjustment reflects the decrease in the entity’s net assets due to impairment and ensures that the balance sheet accurately reflects the entity’s financial position.

- Disclosure Requirements: Entities are required to disclose impairment losses and adjustments to carrying amounts in the notes to financial statements. This disclosure provides stakeholders with insights into the impact of impairment on the entity’s financial position and helps assess the entity’s solvency and liquidity.

Cash Flow Statement: Implications for Cash Flows and Liquidity

- Implications for Cash Flows: Impairment losses recognized in the income statement do not directly affect cash flows. However, impairment may indirectly impact cash flows by reducing future cash-generating abilities or requiring additional investments to replace impaired assets.

- Liquidity Considerations: Impairment testing and recognition of impairment losses may have implications for an entity’s liquidity position. If impairment leads to significant losses or reductions in asset values, entities may need to reassess their liquidity position and ensure sufficient cash reserves to meet financial obligations.

- Disclosures: Entities should provide disclosures in the cash flow statement and notes to financial statements regarding impairment-related cash flows, including any cash payments associated with impairment losses, investments in impaired assets, or changes in cash flow projections due to impairment.

Chapter 8: Disclosure Requirements and Best Practices

Disclosure Framework: Requirements under Ind AS 36

Ind AS 36 Requirements: Ind AS 36 requires entities to provide comprehensive disclosures about impairment of assets in their financial statements. These disclosures are aimed at providing stakeholders with relevant information to understand the nature, extent, and impact of impairment on the entity’s financial position and performance.

Key Disclosure Areas: The standard outlines specific disclosure requirements, including:

- Explanation of the impairment testing methodology used, including key assumptions and inputs.

- Description of significant impairment indicators and triggers considered by the entity.

- Details of impaired assets, including their carrying amounts, recoverable amounts, and impairment losses recognized.

- Information about cash-generating units (CGUs), including their identification, recoverable amounts, and impairment losses allocated.

- Explanation of changes in impairment assessments from the previous reporting period and reasons for significant fluctuations.

- Disclosure of sensitivity analysis conducted to assess the impact of changes in key assumptions on impairment assessments.

- Information about impairment losses reversed or recoveries recognized during the reporting period.

- Disclosure of qualitative factors influencing impairment assessments, such as changes in market conditions, technological advancements, or regulatory requirements.

Best Practices for Transparent and Comprehensive Disclosures

- Adherence to Regulatory Requirements: Entities should ensure compliance with disclosure requirements prescribed by Ind AS 36 and other relevant accounting standards. This includes providing all necessary information and explanations to facilitate stakeholders’ understanding of impairment assessments and their implications.

- Clarity and Transparency: Disclosures should be clear, concise, and transparent, avoiding technical jargon or overly complex language. Information should be presented in a manner that is easily understandable by stakeholders, including investors, creditors, analysts, and regulators.

- Contextual Information: Provide contextual information to help stakeholders interpret impairment disclosures in the broader context of the entity’s operations, industry dynamics, and economic environment. This may include explanations of key drivers influencing impairment assessments, industry benchmarks, and peer comparisons.

- Consistency and Comparability: Ensure consistency and comparability in impairment disclosures over time and across reporting periods. Consistent presentation of information enables stakeholders to track changes in impairment assessments and assess the entity’s performance and financial health over time.

Role of Impairment Disclosures in Stakeholder Communication

- Enhancing Transparency: Impairment disclosures play a crucial role in enhancing the transparency and reliability of financial reporting. By providing stakeholders with comprehensive information about impairment assessments, entities demonstrate their commitment to transparent and accountable financial reporting practices.

- Facilitating Informed Decision-Making: Impairment disclosures enable stakeholders, including investors, creditors, analysts, and regulators, to make informed decisions about the entity’s financial position and performance. Transparent disclosure of impairment assessments helps stakeholders assess the entity’s risk profile, financial health, and prospects.

- Building Stakeholder Trust: Transparent and comprehensive impairment disclosures build trust and confidence among stakeholders, demonstrating the entity’s commitment to open communication and disclosure of material information. Trustworthy financial reporting practices contribute to positive stakeholder relationships and support the entity’s reputation in the marketplace.

- Compliance and Regulatory Requirements: Impairment disclosures also fulfill regulatory requirements and compliance obligations, ensuring that entities adhere to accounting standards and reporting frameworks. Compliance with disclosure requirements helps entities avoid regulatory scrutiny and potential penalties for non-compliance.

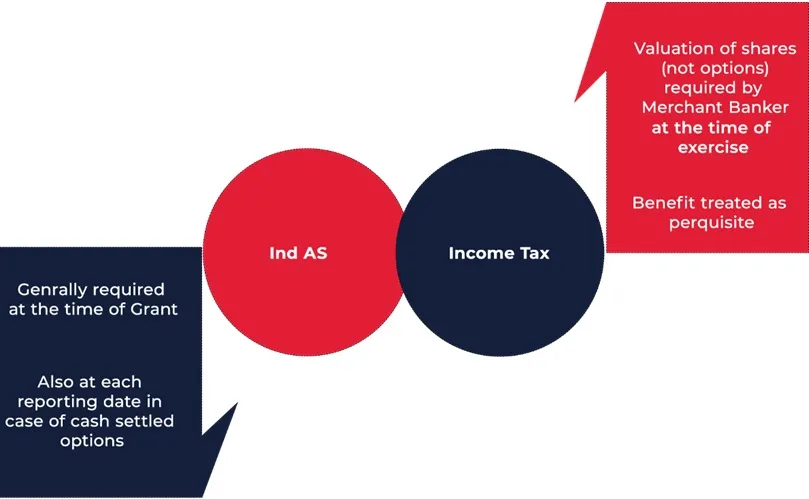

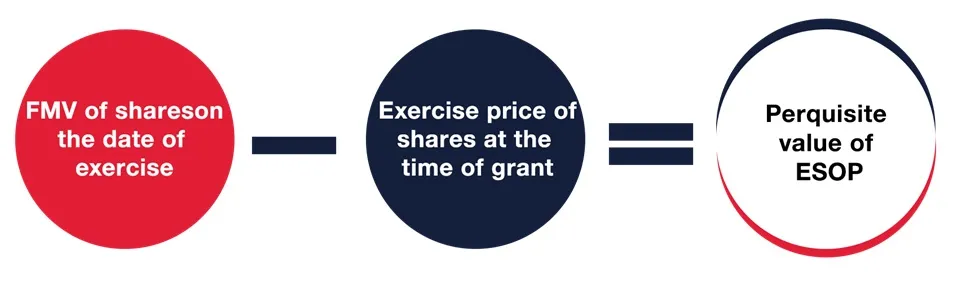

Role of Merchant Banker in Impairment Testing

The role of a merchant banker in impairment testing can vary depending on the specific circumstances of the company and the nature of the assets being evaluated. While impairment testing is typically conducted by the company’s management or its internal or external auditors, merchant bankers may play several roles in this process:

Providing Valuation Expertise: Merchant bankers often have expertise in valuation techniques and methodologies, especially for complex financial instruments or businesses. They can provide valuable insights into the fair value determination process, helping the company assess the recoverable amount of impaired assets accurately.

Assisting with Fair Value Determination: In cases where the fair value of assets needs to be estimated for impairment testing purposes, merchant bankers can assist in conducting valuations. They may use their knowledge of market trends, industry benchmarks, and financial modeling techniques to determine fair values, especially for assets with no active market or observable prices.

Reviewing Internal Valuation Models: Many companies develop internal valuation models to assess the fair value of their assets. Merchant bankers can review these models for accuracy, completeness, and compliance with relevant accounting standards or regulatory requirements. Their independent perspective can enhance the credibility of the valuation process.

Providing Transactional Insights: Merchant bankers often have insights into market transactions, industry dynamics, and economic trends that can inform impairment assessments. They can provide context on recent M&A transactions, financing activities, or changes in market conditions that may impact the recoverable amount of impaired assets.

Offering Strategic Advice: Beyond the technical aspects of impairment testing, merchant bankers can offer strategic advice to the company’s management on how to manage and mitigate impairment risks effectively. This may involve evaluating alternative courses of action, such as asset divestitures, restructuring initiatives, or capital allocation decisions, to optimize the company’s financial position.

Assisting with Disclosure Requirements: Impairment testing results are typically disclosed in the company’s financial statements, along with relevant disclosures about the assumptions and judgments used in the impairment assessment. Merchant bankers can help ensure that these disclosures are transparent, comprehensive, and compliant with accounting standards and regulatory guidelines.

Overall, the role of a merchant banker in impairment testing is to provide expertise, guidance, and support to the company’s management in assessing the recoverable amount of impaired assets accurately and in compliance with applicable accounting standards and regulatory requirements.

How we can help you:

Corporate Professionals Capital Private Limited, a SEBI Registered Category 1 Merchant Banker, boasts over 60 years of cumulative team experience. Our team comprises seasoned experts who have conducted over 3000 valuations for various purposes. Here is how you can get benefit from our expertise:

Valuation Services:

With a proven track record of conducting over 3000 valuations for various purposes, Corporate Professionals Capital offers a wide range of valuation services. These include valuations for mergers and acquisitions, financial reporting, regulatory compliance, tax purposes, fairness opinions, and portfolio valuation.

Tailored Solutions:

Our approach to valuation is highly flexible and tailored to meet the specific needs of our clients. We understand that every situation is unique, and our team is adept at adapting valuation methodologies to suit industry dynamics and regulatory requirements.

Commitment to Quality:

At Corporate Professionals Capital, we are committed to maintaining the highest standards of quality in all our valuation services. Our rigorous quality control processes ensure that every valuation report is accurate, reliable, and thorough.

Client Benefits:

By choosing Corporate Professionals Capital for your valuation needs, you can expect to benefit from our extensive expertise, personalized approach, and unwavering commitment to client satisfaction. We provide our clients with the insights and confidence they need to make informed decisions and achieve their strategic objectives.

Conclusion:

In conclusion, as organizations navigate the dynamic terrain of financial reporting, the mastery of impairment testing emerges as a pivotal skillset. The principles and methodologies delineated in Ind AS 36 provide a robust framework for conducting impairment assessments, ensuring assets are carried at their recoverable amounts.

Embracing these principles not only ensures compliance with regulatory requirements but also fosters transparency and accountability in financial reporting. Diligent implementation of impairment testing methodologies, coupled with robust disclosure practices, serves as a beacon of integrity, guiding organizations towards sustainable growth and stakeholder confidence.

Furthermore, impairment testing plays a crucial role in risk management, enabling organizations to identify and address potential impairment risks in a timely manner. By conducting regular impairment assessments and making informed decisions based on the results, organizations can mitigate the impact of impairment on their financial performance and stability.

+91 98717 84112

+91 98717 84112